FinCEN Mandates BOI Reporting for Brigham City, UT Businesses: File by 01/01/2025 to Avoid Penalties

The Corporate Transparency Act (CTA) requires businesses in Brigham City, UT, to submit Beneficial Ownership Information (BOI) to FinCEN to promote transparency and prevent financial crimes like money laundering and tax evasion.

As of today, 11-26-2024, Brigham City business owners have 36 calendar days (or 27 business days) to file their BOI reports with FinCEN—act now to avoid fines of $500 per day.

Steps for Brigham City Businesses to Stay Compliant

1. Confirm Whether You Need to File

Deadline: ASAP

Most corporations and LLCs must file unless exempt (e.g., banks, nonprofits).

2. Identify Your Beneficial Owners

Deadline: 12-10-2024

Beneficial owners are individuals who:

-

Own at least 25% of the company, or

-

Have substantial control over decisions.

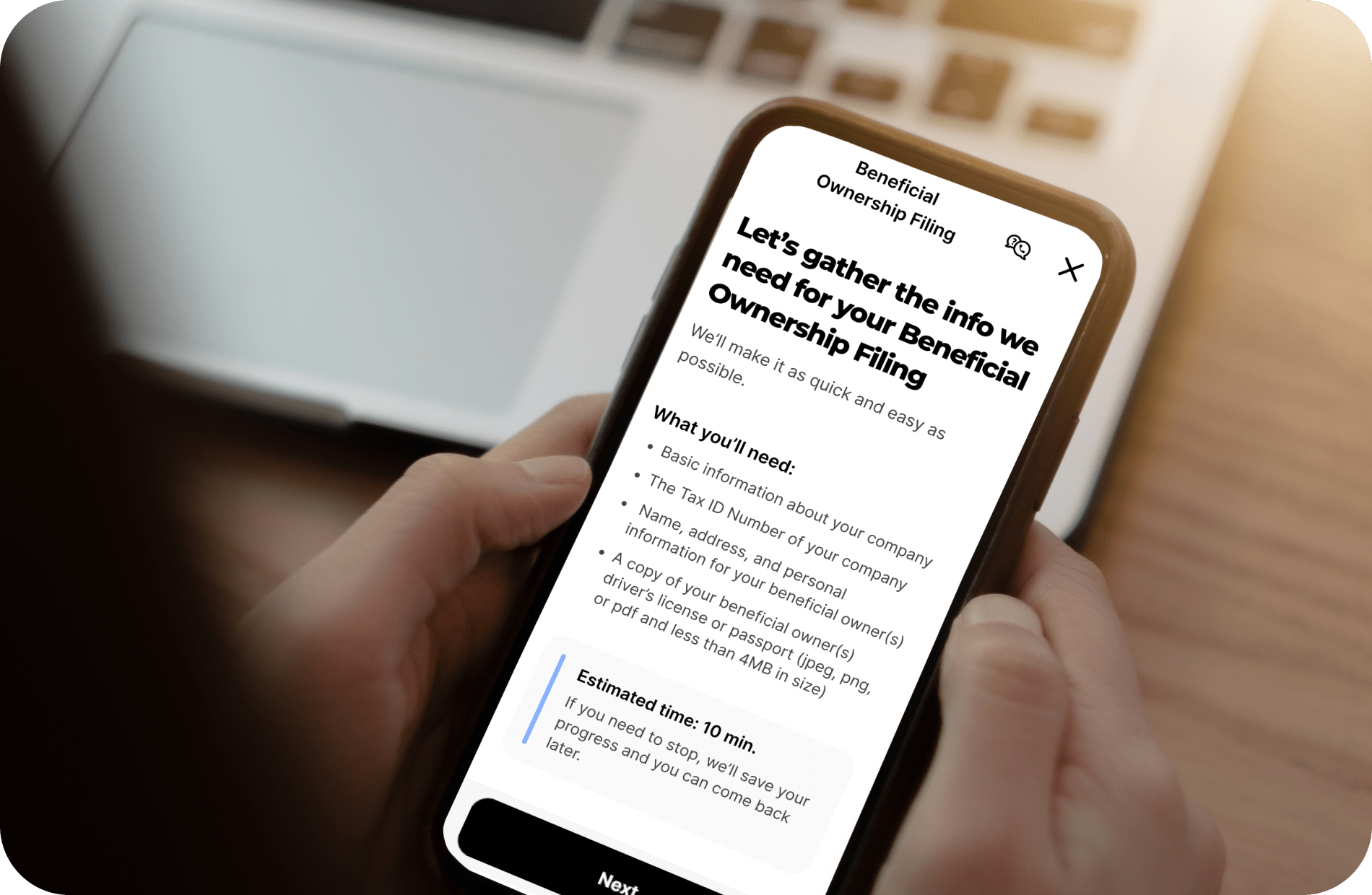

3. Collect Necessary Information

Deadline: 12-17-2024

Prepare the following:

-

Business info: Name, EIN, address.

-

Owner info: Name, address, birthdate, ID details.

4. File Your BOI Report

Deadlines:

-

Existing businesses: File by 01/01/2025.

-

New businesses (2024): File within 90 days of formation.

-

New businesses (2025): File within 30 days of formation.

ZenBusiness can simplify your BOI filing process. Start here.

Important Details About BOI Filing

Who Must File?

"Reporting companies" include most small businesses like LLCs and corporations, except for entities like charities or public companies. For example, a Brigham City café owned by a local entrepreneur would need to file, but a local credit union would not.

Who Is a Beneficial Owner?

A beneficial owner is someone who:

-

Owns 25% or more of the business, or

-

Exercises significant control over operations.

Example: If a Brigham City boutique is co-owned by three partners with equal shares, all three are beneficial owners and must be reported.

What Information Is Needed?

BOI reports require:

-

Company details: Legal name, EIN, physical address.

-

Owner details: Full name, birthdate, residential address, ID information.

How and When to File

Reports must be filed electronically via FinCEN’s platform. Deadlines vary based on the company’s formation date:

-

Existing companies: File by January 1, 2025.

-

New companies (2024): File within 90 days of formation.

-

New companies (2025): File within 30 days of formation.

Penalties for Missing Deadlines

Non-compliance could lead to:

-

Daily fines of $500, accumulating up to $10,000.

-

Criminal penalties, including imprisonment for false filings.

A 90-day grace period allows corrections without penalties.

Why Choose ZenBusiness?

ZenBusiness simplifies BOI reporting with tools that ensure accuracy, save time, and provide peace of mind. Get started with ZenBusiness today.

Additional Resources

Act now to ensure your Brigham City business complies with the 01/01/2025 deadline!

This Hot Deal is promoted by Box Elder Chamber of Commerce.